• $25.8M Revenue, 21% Gross Margin, ($8.6)M Adjusted EBITDA.

• Business continuity maintained with modest COVID-19 impact on Q2 results

VANCOUVER, CANADA – Ballard Power Systems (NASDAQ: BLDP; TSX: BLDP) today announced consolidated financial results for the second quarter ended June 30, 2020.

All amounts are in U.S. dollars unless otherwise noted and have been prepared in accordance with International Financial Reporting Standards (IFRS).

“While the COVID-19 pandemic continues to cause some delays in customer orders, it has not had an appreciable impact on Ballard operations to this point and we continue to take important precautions to mitigate its impact on our people and our business,” said Randy MacEwen, President and CEO. “In Q2 Ballard delivered revenue of $25.8 million, gross margin of 21% and ending cash reserves of $170.3 million.”

Mr. MacEwen noted, “Important recent developments in key geographic markets reaffirm our conviction that a strong future is emerging for the deployment of Fuel Cell Electric Vehicles, or FCEVs, particularly for use cases in which Heavy and Medium Duty Motive applications require heavy payload, extended range, and rapid refueling. Ballard is well-positioned to provide leading fuel cell technology and products in bus, truck, rail and marine applications.”

Mr. MacEwen added, “In China, the Weichai-Ballard joint venture commenced production activities and assembly of fuel cell stacks and modules. We expect the JV to optimize manufacturing processes and start a production ramp through the remainder of 2020. In Europe, the European Commission set out an ambitious phased approach for the transition to hydrogen, proposing that it become an intrinsic part of an integrated energy system. The plan contemplates the deployment of over 40 gigawatts of renewable hydrogen electrolyzers, producing up to 10 million tons of hydrogen by 2030. In California, the California Air Resources Board passed the Advanced Clean Truck Regulation, which requires increasing percentages of new truck purchases to be zero-emission, starting in 2024 and with 75% of all new Class 4 to 8 trucks and 40% of all new Class 7 and 8 tractors to be zero-emission by 2035, and 100% by 2045. Subsequently, fifteen U.S. states indicated their intention to implement a similar mandate, starting with a requirement for 30% of new medium- and heavy-duty truck sales to be zero-emission by 2030, increasing to 100% by 2050.”

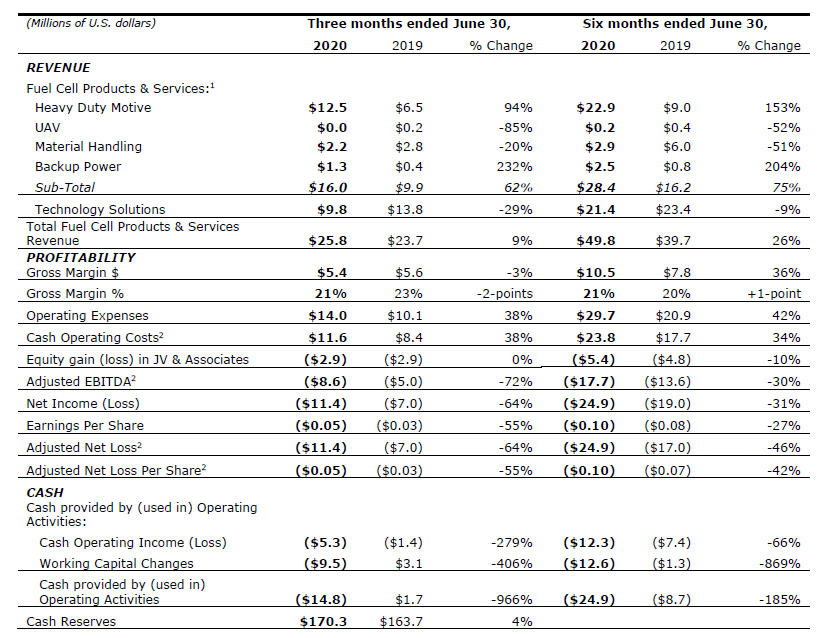

Q2 2020 Financial Highlights

(all comparisons are to Q2 2019 unless otherwise noted)

- Total revenue was $25.8 million in the quarter, a year-over-year increase of 9% or $2.2 million, primarily the result of higher shipments of Heavy Duty Motive products.

- The Power Products platform generated revenue of $16.0 million in the quarter, an increase of 62% or $6.1 million:

- Heavy Duty Motive revenue was $12.5 million, an increase of 94% or $6.1 million, due primarily to higher shipments of fuel cell products to customers in China;

- Material Handling revenue was $2.2 million, a decrease of 20% or $0.6 million, primarily the result of lower fuel cell stack shipments to Plug Power; and

- Backup Power revenue was $1.3 million, an increase of 232% or $0.9 million, due primarily to an increase in sales of hydrogen-based backup power fuel cell stacks to Europe and Asia, combined with a minor increase in hydrogen-based backup power systems and service revenues in Europe.

- The Technology Solutions platform generated revenue of $9.8 million in the quarter, a decrease of 29% or $4.0 million, due primarily to decreased amounts earned on the Audi program, the Weichai-Ballard JV technology transfer program, and the Siemens development program. Full-year Technology Solutions revenue is expected to be lower than in 2019 partly due to reduced program scope, as certain planned activities have been completed, and deferral of certain development work on certain programs in view of COVID-19.

- Gross margin was 21% in Q2, a decrease of 2-points due primarily to a shift to lower overall product margin and service revenue mix.

- Cash operating costs2 were $11.6 million in the quarter, a 38% increase primarily attributable to increased expenditure on technology and product development expenses related to work on next-generation stacks and modules for bus, truck, rail and marine applications as well as higher general and administrative expenses.

- Adjusted EBITDA2 was ($8.6) million, compared to ($5.0) million in Q2 2019, primarily as a result of higher cash operating costs.

- Net loss and adjusted net loss were ($11.4) million in the quarter, declines of 64%.

- Net loss per share2 and adjusted net loss per share2 were ($0.05), declines of 55%.

- Cash used by operating activities was ($14.8) million, a decline of 966%, reflecting cash operating loss of ($5.3) million and use in working capital of ($9.5) million.

- Cash reserves were $170.3 million at June 30, 2020, an increase of 4% from the end of Q2 2019 and a decrease of 6% from the end of the prior quarter. An additional $12.2 million of cash was raised in the quarter from an At-The-Market Equity Program. Ballard also made a further capital contribution of $6.4 million to the Weichai-Ballard JV in the quarter.

- During Q1 Ballard received $11.9 million in new orders, partially reflecting the impact of COVID-19 on timing of customer orders, and delivered orders valued at $25.8 million, resulting in a decrease in the Order Backlog of $13.9 million from the prior quarter, ending Q2 at $155.5 million. The 12-month Order Book was $101.0 million at end-Q2, a decrease of $4.8 million from the prior quarter.

Q2 2020 Operating Highlights

- Received follow-on purchase orders from Wrightbus for 15 of Ballard’s 85-kilowatt FCveloCity®-HD fuel cell modules to power Fuel Cell Electric Buses (FCEBs) planned for deployment in the U.K. With these orders, Ballard currently has orders in-hand from Wrightbus for a total of 50 modules to power FCEBs in the U.K., including planned deployments in the cities of London and Aberdeen.

- Signed a non-binding Memorandum of Understanding with consortium partners to establish the H2OzBus Project which will develop detailed plans for a local transit authority for a first phase deployment of 100 FCEBs in 10 central hub locations across Australia, including the use of ‘green hydrogen’ produced from renewable energy.

- Filed a final short form base shelf prospectus (Prospectus), and a related U.S. registration statement on Form F-10 (Registration Statement), for $750 million, which provides the flexibility to make offerings of securities during the effective period of the Prospectus and Registration Statement, until July 2022.

- Celebrated the Company’s 25th anniversary on the Nasdaq stock exchange, having initially been listed in 1995.

- Subsequent to the quarter:

-

- The Weichai-Ballard joint venture began production activities and assembly of next-generation fuel cell stacks and modules. Manufacturing processes are expected to be optimized and a production ramp started through the remainder of 2020.

- Received a purchase order for $7.7 million of membrane electrode assemblies (MEAs) for use in manufacturing FCvelocity®-9SSL fuel cell stacks, from Guangdong Synergy Ballard Hydrogen Power Co., Ltd. (Synergy-Ballard JVCo), a joint venture in which Ballard holds a 10% ownership interest.

- Recognized that several California transit agencies – including Orange County Transportation Authority (OCTA) and Alameda-Contra Costa Transit District (AC Transit) – have now issued zero-emission bus rollout plans in compliance with CARB’s Innovative Clean Transit Regulation, which requires the scaled adoption of zero-emission buses in California. Under the regulation, 100% of all bus fleets in California must be zero-emission by 2040.

- Noted that the European Commission unveiled its Industrial Strategy and issued its report “A Hydrogen Strategy for a Climate-Neutral Europe”. In addition to industrial uses of hydrogen, the European Commission’s report focuses on transportation applications, including buses, commercial fleets of cars and heavy-duty road vehicles, rail and marine vessels.

Announced that on-road commercial Fuel Cell Electric Vehicles powered by Ballard fuel cell technology have now driven over 50 million kilometers, an industry-leading metric and enough to circle the globe 1,250 times.

Q2 2020 Financial Summary

For a more detailed discussion of Ballard Power Systems’ second quarter 2020 results, please see the company’s financial statements and management’s discussion & analysis, which are available at www.ballard.com/investors, www.sedar.com and www.sec.gov/edgar.shtml.

Conference Call

Ballard will hold a conference call on Thursday, August 6, 2020 at 8:00 a.m. Pacific Time (11:00 a.m. Eastern Time) to review second quarter 2020 operating results. The live call can be accessed by dialing +1.604.638.5340. Alternatively, a live audio and slide webcast can be accessed through a link on Ballard’s homepage (www.ballard.com). Following the call, the audio webcast and presentation materials will be archived in the ‘Earnings, Interviews & Presentations’ area of the ‘Investors’ section of Ballard’s website (www.ballard.com/investors).

About Ballard Power Systems

Ballard Power Systems’ (NASDAQ: BLDP; TSX: BLDP) vision is to deliver fuel cell power for a sustainable planet. Ballard zero-emission PEM fuel cells are enabling electrification of mobility, including buses, commercial trucks, trains, marine vessels, passenger cars, forklift trucks and UAVs. To learn more about Ballard, please visit www.ballard.com.

Important Cautions Regarding Forward-Looking Statements

This release contains forward-looking statements concerning the impact of the coronavirus pandemic on our business and on the long-term demand for fuel cell products, projected product orders and sales and product shipments, expected manufacturing progress at the Weichai-Ballard joint venture, the markets for our products and the effects of governmental regulations on such markets, expected financial results and future offerings of securities. These forward-looking statements reflect Ballard’s current expectations as contemplated under section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Any such statements are based on Ballard’s assumptions relating to its financial forecasts and expectations regarding its product development efforts, manufacturing capacity, and market demand. For a detailed discussion of the factors and assumptions that these statements are based upon, and factors that could cause our actual results or outcomes to differ materially, please refer to Ballard’s most recent management discussion & analysis. Other risks and uncertainties that may cause Ballard’s actual results to be materially different include general economic and regulatory changes, detrimental reliance on third parties, successfully achieving our business plans and achieving and sustaining profitability. For a detailed discussion of these and other risk factors that could affect Ballard’s future performance, please refer to Ballard’s most recent Annual Information Form. These forward-looking statements are provided to enable external stakeholders to understand Ballard’s expectations as at the date of this release and may not be appropriate for other purposes. Readers should not place undue reliance on these statements and Ballard assumes no obligation to update or release any revisions to them, other than as required under applicable legislation.

Further Information

Guy McAree +1.604.412.7919, [email protected]

Read the most up to date Fuel Cell and Hydrogen Industry news at FuelCellsWorks