Private capital is pouring into startups and established companies tied up in the growing hydrogen economy at never-before-seen levels, PitchBook data shows.

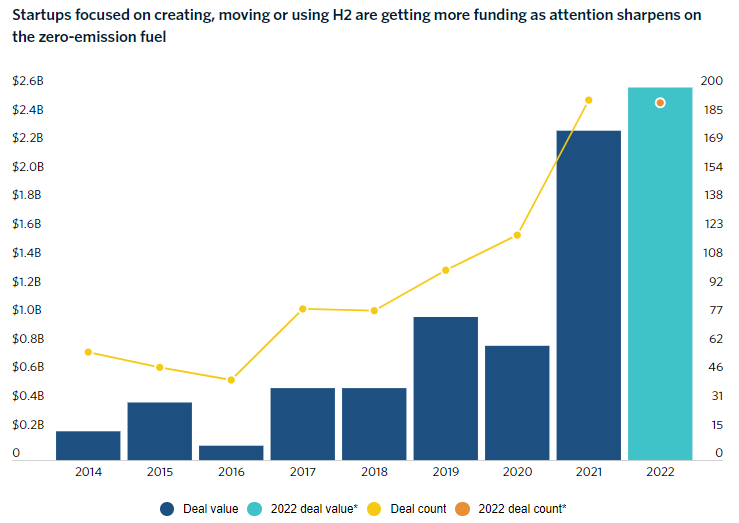

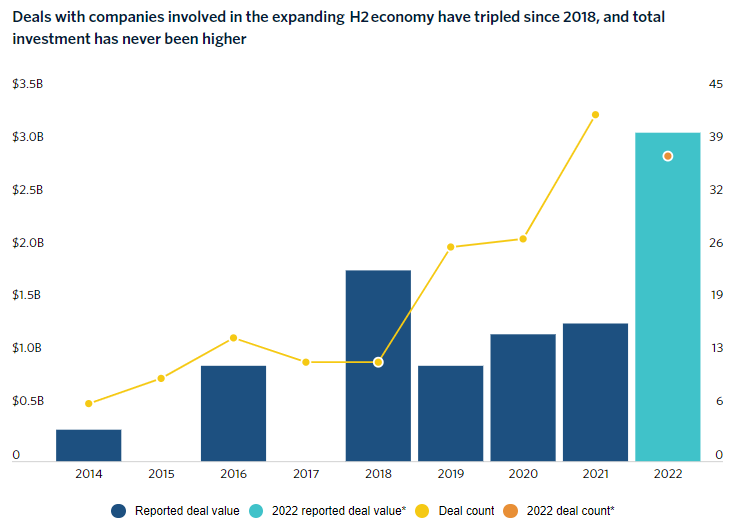

VC and PE firms alike have deployed more capital into global companies making, moving or using hydrogen—or planning to do so—in 2022 than any prior year. And on the venture side, total deal count also broke a record this year.

Through most of 2022, PE firms spent $3.1 billion on hydrogen-related companies across 37 deals, while venture firms invested $2.6 billion, in 192 startups. Since 2014, the number of annual VC hydrogen deals has more than tripled as PE deal count quadrupled.

VCs have broken a record in 2022 through their investments in hydrogen-related companies

Hydrogen’s takeoff in the private markets comes in the wake of governmental and corporate commitments in Europe, Asia and North America to build out hydrogen infrastructure and encourage its use to tamp down on fossil fuel emissions, which contribute to global warming.

PE spending on hydrogen-related companies spikedto more than $3B in 2022

Oregon-based Intersect Power raised $750 million in growth equity this year from TPG, Trilantic North America, Climate Adaptive Infrastructure and others, making it the largest hydrogen PE deal of 2022 and the heftiest growth equity raise for a hydrogen-ambitious company ever, according to PitchBook data. Intersect develops and operates solar power generation and utility-scale battery storage assets and plans to expand into green hydrogen production.

Over the summer, VC-backed Monolith—which says it has cracked the code on splitting natural gas into pure streams of hydrogen and carbon in a cost-effective manner—raised a $300 million Series D growth equity round led by TPG and Decarbonization Partners. The latter firm was founded this year as a joint venture of Temasek Holdings and BlackRock, and it plans to make investments in companies that aim to transition the economy to more renewable energy sources.

Read the most up to date Fuel Cell and Hydrogen Industry news at FuelCellsWorks

Some of the biggest VC rounds this year, for Germany-based Sunfire and Bay Area-based Electric Hydrogen, saw more than $400 million invested in zero-emission hydrogen production.

SOURCE: PitchBook