Carbon capture, utilization and storage (CCUS) has long been discussed as one of the major strategic and tactical plans that could be implemented to manage, mitigate and ultimately reduce the amount of carbon being added to our environment. Berend Smit, et. al.’s 2014 article The Grand Challenges in Carbon Capture, Utilization and Storage published in Frontiers in Energy Research declared that “If we were in a global war against climate change, we would carry out large-scale CCUS.” Using hydrogen as a clean fuel is also not a new idea—natural gas reforming as a source of hydrogen saw significant interest, if not commercial traction, in the early 2000’s with dozens of fuel cell projects being announced and then quietly disappearing.

While the challenges of climate change are not new, and the energy industry has been a leader in the development of technologies that can be applied to reduce emissions as well as their intensity, the sector is increasingly being called upon to do the heavy lifting in the fight against climate change. With its recent 2030 emissions reduction plan, the federal government is demanding that Canada’s oil and gas sector reduce its emissions by 42% below 2019 levels within the next 8 years.

These goals are lofty but there are some silver linings in what many might see as a dark cloud for the energy sector in Canada.

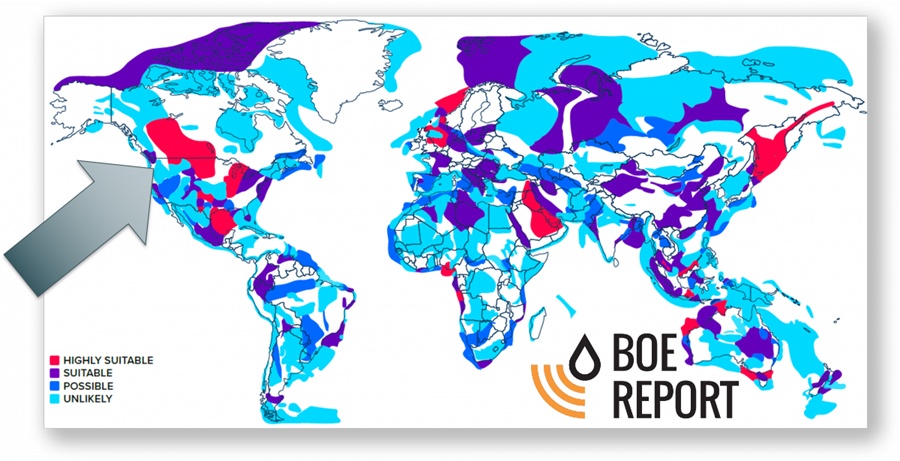

When considering CCUS, the significant challenge has always been how to make projects commercial and economically viable. Just like the development of unconventional oil and gas projects, including the oil sands, CCUS requires the deployment of large amounts of capital to realize long-term projects including significant infrastructure assets. While that might lead some to think that you can just spend your way out of the problem, globally there are limited areas with the geology suited for long-term, underground CO2 storage.

The good news for industry is that western Canada is in a unique position to create opportunities for CCUS projects where many other areas of the world would face significantly greater challenges. According to the Global CCS Institute, there are four primary enablers for CCUS projects to become operationally and economically viable. The first is access to high-concentration CO2 streams and high-quality geological storage formations. Western Canada and Alberta, in particular have both. Access to the Alberta Carbon Trunk Line and the energy industry literally sitting atop the Western Canadian Sedimentary Basin (WCSB) fill both needs. In fact, the Western Canadian Sedimentary Basin is the largest of only about 20 global geological formations ideally suited for long-term CO2 storage.

The second enabler is a bankable and material source of revenue. In Western Canada, many companies’ production assets are currently or will soon be candidates for enhanced oil recovery (EOR) and produced CO2 from sources such as the oil sands is a prime option for these floods. In additional to added-value projects through EOR, the established carbon pricing regime in Canada provides an important revenue stream……the backstop of economic CCS projects…

The third and fourth enablers according to the Global CCS Institute relate to positive and predictable regulation and government support. The Government of Canada’s recent budget announcement of up to $2.6 Billion in tax credits offset up to 60% of the costs of CCUS projects in the country. This, combined with supports from provincial governments and an increasingly positive policy environment and acceptance of CCUS as a method to reduce greenhouse gas emissions from the energy sector points to an alignment of different orders of government on the potential of CCUS. What this means for the oil and gas industry is that many more projects will become much more economic.

When it comes to hydrogen, governments are very quickly developing a renewed interest in projects and have come full circle in their support for technological and operational developments in hopes of driving its commercial adoption as a low carbon fuel option. In November 2021, the Alberta Government released a roadmap to building a hydrogen economy and in April this year, it announced a $50 million contribution to establish a Hydrogen Centre of Excellence within Alberta Innovates. The funds will be used to “drive innovation in the production and use of hydrogen in Alberta.” While Alberta already produces 2.4 million tonnes of hydrogen per year, clearly, policy makers see potential in an industry that some expect to see grow to between $2.5 and $11 TRILLION globally by 2050. Alberta’s Hydrogen Roadmap suggests that the global sale of hydrogen could exceed $700 billion by 2050. Alberta’s Associate Minister of Natural Gas and Electricity recently noted that he is aware of at least $14 billion of hydrogen investments that have been announced just in the past year.

So now that there is a political and economic environment that supports CCUS, companies have the significant challenge, and opportunity to assess whether their projects can take advantage of these new parameters. Carbon Capture Utilization and Storage is crucial to our energy future. GLJ’s work builds on the most extensive reservoir assessments in the country. We have screened literally every reservoir in the WCSB and the results clearly show that Canada has the potential to be the world leader in CCUS.

Reference: GLJ, 2021

Alberta also has the potential to become a world leader in hydrogen production but in order to get there, we need to embrace the technology of natural gas reforming combined with CCUS. GLJ has conducted many technical-economic studies of these combined processes with real-world cash flow analysis models. In the chart above, we can see cases in Alberta where a combination of favourable hydrogen prices ($1.50+ /kgH2) and carbon credit pricing ($75+ /kgCO2) can begin to provide a favourable rate-of-return required to make commitments to develop the necessary infrastructure. Risk and uncertainties remain in the equation, however, so working with a trusted partner is critical to help manage the process.

With over 50 years of energy consulting experience and over 30 years of CCUS experience, GLJ is the leader in assessing site selection, economics and utilization of carbon as a commodity. We have advised on CO2 EOR and sequestration projects for governments, producers, midstream and industrial partner clients in Canada and around the world. At conferences from London to Vienna and Houston to Australia, GLJ and our Canadian expertise is the go-to source for reliable, accurate and robust advice on CCUS and hydrogen initiatives.

We can identify strategic CCS/CCUS and hydrogen opportunities to help you make the decisions on your projects. Our advanced static and dynamic modeling abilities led by our dedicated CCUS and hydrogen team of experts can help you get more out of your reservoirs through

- site characterization

- reservoir injection modeling and CO2 sequestration modeling

- project planning and economic modeling

- regulatory and funding applications

- resourcing plans and partner identification

- complete evaluation and reporting

- decarbonization pathways and sustainability planning/reporting

GLJ is the leader in CCUS and hydrogen evaluation, modeling and assessment. Get in touch with us to see how we can help your company unlock and capture the value of its carbon.

Read the most up to date Fuel Cell and Hydrogen Industry news at FuelCellsWorks