Highlights:

- Preliminary Feasibility Study (PFS) anticipated to be completed in Q2

- Targeting FEED entry Q4 2023 and FID Q4 2024, subject to results of the

WAH2 Project Review

The Hexagon team has decided to progress to a Preliminary Feasibility Study with respect to the WAH2 project.

Specific areas of analysis, among others, in the PFS will include:

- Hydrogen production methodology;

- Energy carrier solution;

- Site location and availability of land;

- Project scaling and phasing of production;

- Gas supply;

- Carbon capture and storage;

- Production technology alternatives; and

- Identification of enhancements to minimise capital and operating

Chairman Charles Whitfield commented: “Key questions around availability of input gas and CO2 sequestration capacity from already planned providers have been addressed, clearing a major hurdle to the viability of the project. The Company will now move ahead with a Preliminary Feasibility Study which is anticipated to be completed in Q2 of this year. In parallel with this, key commercial discussions with input and service providers, the WA Government, potential off-takers and strategic partners will all be progressed. I’d like to thank the hydrogen team including Stephen Hall and Andrew Kirk for their diligence in contributing to the next stage in the project development”.

Pre-Feasibility Study

The Pre-Feasibility Study will include particular focus on various elements associated with the WAH2 project including:

Carbon capture and storage

Several credible CO2 sequestration alternatives are being developed proximal to WAH2.

Greenhouse gas assessment permits have been awarded to joint ventures operated by Santos (G-9-AP) and Woodside (G-10-AP), and the Australian Gas Infrastructure Group is investigating the potential to use its wholly owned Tubridgi asset for CO2 sequestration.

Production technology

The choice of specific hydrogen production technology drives tangible differences in plant costs, power requirements and CO2 emissions. Steam methane reforming, autothermal reforming and gas heated reforming are all under consideration.

Project enhancement opportunities

Opportunities have been identified to reduce unit costs and leverage economies of scale. These include:

- Optimal technology choice and sizing of Phase 1 of the WAH2 project;

- Potential access to multi-user infrastructure including utilities import, product export and CO2 transmission; and

- An optimised power

Next steps

The focus of the Hexagon team has now turned to completing the WAH2 Project PFS in Q2 2023 and, in parallel:

- progressing commercial discussions regarding gas supply, utilities, CO2 sequestration and ammonia offtake; and

- securing an Option to Lease from the WA Government over Hexagon’s preferred project

Background to the WAH2 low-carbon hydrogen project

Hydrogen production methodology

Competitive, low-carbon, low-risk hydrogen is proposed to be delivered by using proven technology to reform natural gas feedstock, carbon capture and storage (CCS) in depleted gas reservoirs and harnessing northern Western Australia’s renewable energy potential.

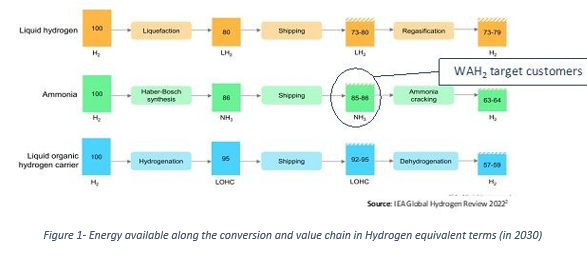

Energy carrier

The produced hydrogen is proposed to be converted to low-carbon ammonia as the most appropriate energy carrier. This offers reduced processing and transportation costs and greater energy-efficiency than the alternatives of liquid hydrogen or liquid organic hydrogen carriers – and aligns with customers’ need for ammonia.

Note to Figure 1: LH2 = liquefied hydrogen; NH3 = ammonia; LOHC = liquid organic hydrogen carrier. Numbers show the remaining energy content of hydrogen along the supply chain relative to a starting value of 100, assuming that all energy needs of the steps would be covered by the hydrogen or hydrogen-derived fuel. The Haber-Bosch synthesis process includes energy consumption in the air separation unit. Boil-off losses from shipping are based on a distance of 8 000 km. For LH2, dashed areas represent energy being recovered by using the boil-off gases as shipping fuel, corresponding to the upper range numbers. For NH3 and LOHC, the dashed area represents the energy requirements for one-way shipping, which are included in the lower range numbers.

Site location

Hexagon has identified its preferred site for WAH2 and has applied to the WA Government for a long-term lease over the site (HXG ASX Announcements 26 July, 31 October, and 30 November 2022).

The proposed site is in an existing Strategic Industrial Area in northern Western Australia. It is proximal to services, with established export routes and an existing infrastructure corridor. It is well-placed to access key Asian markets such as Japan and South Korea and to provide domestic supply to Australia (HXG ASX Announcements 26 July and 31 October 2022).

Gas Supply

WAH2’s feed-gas requirement is small in the context of the WA gas market.

There are several potential suppliers with access to existing distribution infrastructure and Phase 1 of the project would consume only ~2% of Western Australia’s forecast daily gas supply at the expected time of start-up (Base Case, WA GSOO 2022).

Read the most up to date Fuel Cell and Hydrogen Industry news at FuelCellsWorks

ABOUT HEXAGON ENERGY MATERIALS LIMITED

Hexagon Energy Materials Limited (ASX: HXG) is an Australian company focused on future energy project development and energy materials exploration and project development.

Hexagon 100% owns the McIntosh Nickel-Copper-PGE and Graphite project and the Halls Creek Gold and Base metals projects in Western Australia. On 14 February 2022 Hexagon announced a binding Graphite Mineral Rights Earn-in agreement (up to 80%) had been entered into with Critical Green Minerals Pty Ltd, with McIntosh graphite expected to become part of an ASX Initial Public Offering during 2023. In the USA, Hexagon has an 80 per cent controlling interest of the Ceylon Graphite project located in Alabama, over which South Star Battery Materials Corp (TSXV: STS) on 7 December 2021 signed an Option to develop and Earn-In up to 75% interest.

Hexagon also is developing a business to deliver decarbonised Hydrogen (blue Ammonia) into export and domestic markets at scale via its WAH2 project.

Hexagon’s plan is to use renewable energy in clean Hydrogen production to the greatest extent possible in its projects, transitioning from blue to green Hydrogen production on a commercial basis, over time. Supporting this strategy in January 2022 Hexagon signed a Memorandum of Understanding with renewable energy company FRV Services Australia Pty Ltd (FRV Australia) (51% owned by Fotowatio Renewable Ventures SL and 49% owned by OMERS Infrastructure part of OMERS Canadian defined benefit pension plan fund). FRV has almost 800MWdc of Australian PV assets built or under construction in Australia.

Hexagon’s overarching goal for 2023 is to secure and leverage technical and commercial alliances by commodity across its project portfolio whilst maintaining a core focus on Northern Australian Future Energy and Future Energy Materials projects, in-house. The graphics below summarise Hexagon’s strategy and the locations of Hexagon’s projects.