VANCOUVER, CANADA – Ballard Power Systems (NASDAQ: BLDP; TSX: BLDP) today announced consolidated financial results for the first quarter ended March 31, 2020.

All amounts are in U.S. dollars unless otherwise noted and have been prepared in accordance with International Financial Reporting Standards (IFRS).

“Our top priority, always, is the health and safety of our people, customers and partners,” said Randy MacEwen, President and CEO. “We have taken important precautions to mitigate the impact of the COVID-19 pandemic on our people and our business. Notwithstanding this extraordinary backdrop, we delivered record Q1 revenue of $24.0 million, gross margin of 22% and ending cash reserves of $181.6 million. We further fortified our balance sheet, with the execution of an At-The-Market Equity Program.”

Mr. MacEwen stated, “Although we are not seeing a pull-back in long-term demand as a result of COVID-19, there are now some uncertainties on the timelines for vehicle deployments by end-customers. As a result, we believe it is prudent and responsible for us to withdraw our 2020 revenue outlook at this time.”

Mr. MacEwen commented, “As we look past possible delays due to near-term uncertainties, we believe the post-COVID-19 ‘new normal’ will offer opportunities to accelerate and further deepen our market penetration. We expect increased calls globally to address urban air quality, as recent studies have demonstrated a link between long-term exposure to particulate matter below 2.5 microns, or PM2.5, and COVID-19 mortality rates. We also expect the European Green Deal, as well as infrastructure stimulus packages in key markets, to promote the adoption of zero-emission mobility in a green recovery. The new paradigm will also likely see increased e-commerce, with a resultant increase in long-term demand for zero-emission medium- and heavy-duty logistics trucks – a market that has traditionally been difficult to decarbonize and a market where we expect fuel cell electrification to be the zero-emission powertrain of choice.”

Mr. MacEwen further concluded, “The recent announcement by Daimler Truck and Volvo Group to collaborate on sustainable transportation by forming a joint venture for large-scale production of fuel cells is yet another validation of our strategic view of the market. We believe mass commercialization of fuel cell electric vehicles will occur first in medium and heavy-duty motive use cases – including bus, truck, train and marine – where there are zero-emission requirements for heavy payload, long range and rapid refueling. Many of these use cases feature return-to-base duty cycles, where vehicles can be quickly refueled at a centralized hydrogen refueling station, consistent with the current user experience with legacy diesel. These use cases also disproportionately contribute to emissions, including carbon dioxide and PM2.5.”

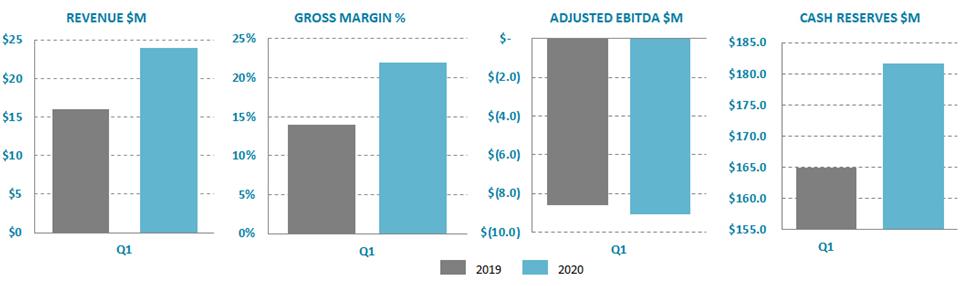

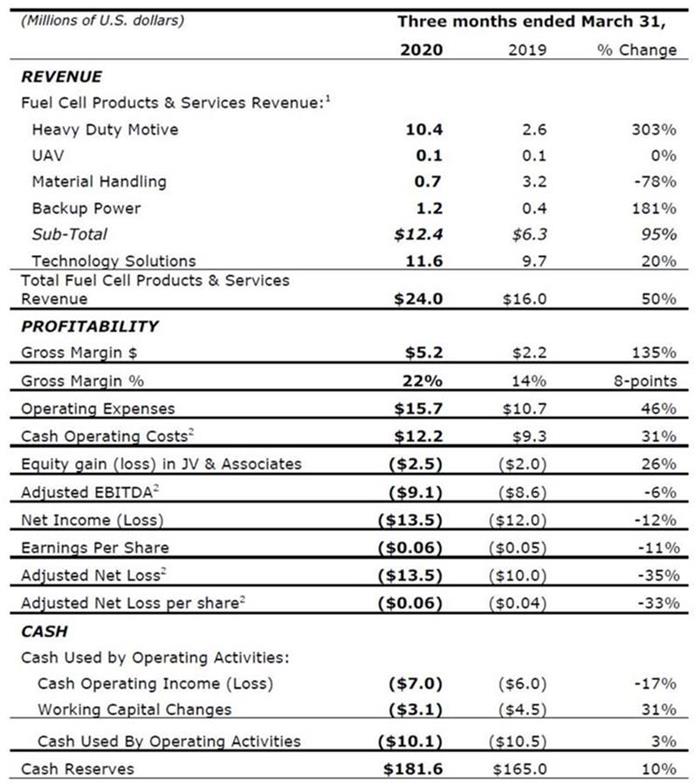

Q1 2020 Financial Highlights

(all comparisons are to Q1 2019 unless otherwise noted)

- Total revenue was $24.0 million in the quarter, a year-over-year increase of 50% or $8.0 million, primarily the result of higher shipments of Heavy Duty Motive products, as well as higher Technology Solutions revenue.

- The Power Products platform generated revenue of $12.3 million in the quarter, an increase of 95% or $6.0 million:

- Heavy Duty Motive revenue was $10.4 million, an increase of 303% or $7.8 million, due primarily to higher shipments of module parts kits and MEAs to China;

- Material Handling revenue was $0.7 million, a decrease of 78% or $2.5 million, primarily the result of lower fuel cell stack shipments to Plug Power; and

- Backup Power revenue was $1.2 million, an increase of 181% or $0.8 million, due primarily to an increase in hydrogen-based fuel cell stacks to Asia.

- The Technology Solutions platform generated revenue of $11.6 million in the quarter, an increase of 20% or $1.9 million, due primarily to amounts earned from the Audi program and the Weichai-Ballard joint venture (JV) technology transfer program, which more than offset minor declines in other programs in the period.

- Gross margin was 22% in Q1, an improvement of 8-points due primarily to a shift toward a higher overall margin product and service revenue mix.

- Cash operating costs2 were $12.2 million in the quarter, a 31% increase primarily attributable to increased expenditure on technology and product development expenses.

- Adjusted EBITDA2 was ($9.1) million, compared to ($8.6) million in Q1 2019, primarily as a result of higher equity loss in the Weichai-Ballard JV.

- Net loss was ($13.5) million in the quarter, an increase of 12% and adjusted net loss was ($13.5), an increase of 35%.

Net loss per share2 was ($0.06), an increase of 11% and adjusted net loss per share2 was ($0.06), an increase of 33%.

- Cash used by operating activities was ($10.1) million, an improvement of 3%, reflecting cash operating loss of ($7.0) million and use in working capital of ($3.1) million.

- Cash reserves were $181.6 million at March 31, 2020, an increase of 10% from the end of Q1 2019 and an increase of 33% from the end of the prior quarter, reflecting net $52.6 million of cash raised in the quarter from partial execution of an At-The-Market Equity Program. Ballard also made a further capital contribution of $6.5 million to the Weichai-Ballard JV in the quarter.

- During Q1 Ballard received $14.8 million in new orders and delivered orders valued at $24.0 million, reducing the Order Backlog by $9.2 million from the prior quarter, ending Q1 at $169.5 million. The 12-month Order Book was $105.8 million at end-Q1, a decrease of $4.5 million from the prior quarter.

Q1 2020 Operating Highlights

- Issued a white paper with Deloitte China titled “Fueling the Future of Mobility: Hydrogen and fuel cell solutions for transportation” at the Consumer Technology Association’s CES 2020 trade show in Las Vegas, Nevada. The white paper includes detailed total-cost-of-ownership analyses, concluding that it will be less expensive to run Fuel Cell Electric Vehicles (FCEVs) than battery electric vehicles (BEVs) or internal combustion engine (ICE) vehicles in less than 10 years’ time.

- Signed Equipment Sales Agreements for the provision of an initial 500 FCgen®-1020ACS fuel cell stacks to adKor GmbH and SFC Energy AG, to be integrated into Jupiter backup power systems for deployment at radio tower sites in Germany through the end of 2021.

- Announced the Company’s fuel cell technology and products had successfully powered FCEVs in commercial Heavy- and Medium-Duty Motive applications for an industry-leading cumulative total of more than 30 million kilometers on roads around the globe.

- Announced a purchase order from Solaris Bus & Coach SA for FCmoveTM-HD fuel cell modules to power 25 buses, including 15 buses for deployment in Cologne and 10 buses for deployment in Wuppertal, Germany under the JIVE2 funding program.

- Subsequent to the quarter, announced a follow-on purchase order from Solaris Bus & Coach SA for FCmoveTM-HD fuel cell modules to power 20 buses to be deployed in The Netherlands under the JIVE2 funding program.

Entered into an At-The-Market (ATM) Equity Distribution Agreement and launched an ATM Program which added approximately net $52.6 million to cash reserves in the quarter, with an additional approximately net $12.3 million added in April. Together these transactions increased Ballard’s cash reserves by approximately net $64.9 million.

Q1 2020 Financial Summary

For a more detailed discussion of Ballard Power Systems’ first quarter 2020 results, please see the company’s financial statements and management’s discussion & analysis, which are available at www.ballard.com/investors, www.sedar.com and www.sec.gov/edgar.shtml.

Read the most up to date Fuel Cell and Hydrogen Industry news at FuelCellsWorks