• Hydrogen optionality at the Leigh Creek Energy Project

• LCK can produce 200,000,000 kg of Hydrogen per annum

• LCK will be the lowest cost producer in Australia at less than $1 per kg

• LCK successfully produced Hydrogen at Leigh Creek

The Option for Hydrogen

LCK successfully produced significant quantities of hydrogen at its flagship Leigh Creek Energy Project (LCEP) pre-commercial demonstration.

“We recognized, through our testing program, the commercial potential of producing large quantities of ultra-low-cost hydrogen. The LCEP has the ability to produce over 200,000,000 kg of hydrogen per year and LCK has been actively monitoring the hydrogen market and the governmental desire to encourage this development. In Australia, the market for hydrogen had seemed too immature in terms of time and market participants but things are changing rapidly and the business for hydrogen now warrants further analysis.”

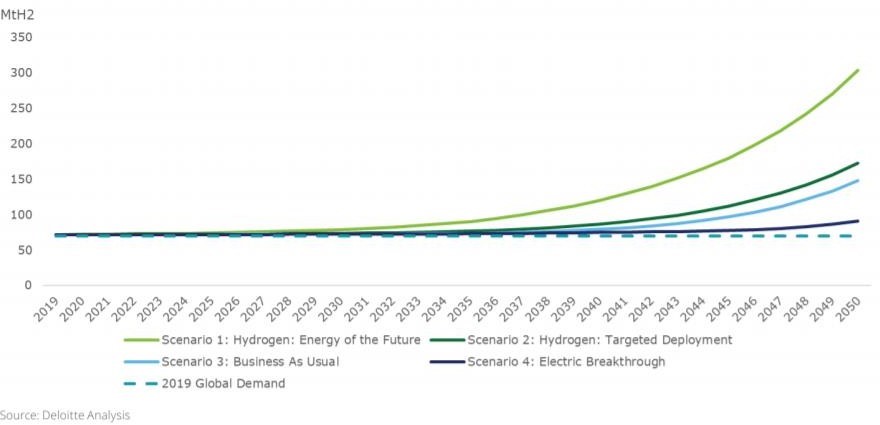

The Hydrogen Market

Global demand

Hydrogen is a high energy fuel that can be produced as a gas, liquid, or as a component of other energy sources. It has many uses as a fuel in transport, heating, electricity, and as a raw material in industrial processes.

Many governments have identified the potential of Hydrogen to become a significant commercial energy source that could ultimately economically deliver a zero-carbon.

Consequently, hydrogen is currently enjoying unprecedented political and business momentum, with the demand expanding rapidly. Currently, the world market is estimated as $100Bn+ with an annual growth rate of 6%-8%.

Global demand for pure hydrogen, 1975-2018 (Source: International Energy Agency)

Australian Demand

Australia’s Hydrogen market is small with niche markets in the industrial sector. It is forecast as a significant potential growth area. The Australian Renewable Energy Agency has forecast demand for Hydrogen exports could be over three million tonnes by 2040.

Australia’s Hydrogen market is small with niche markets in the industrial sector. It is forecast as a significant potential growth area. The Australian Renewable Energy Agency has forecast demand for Hydrogen exports could be over three million tonnes by 2040.

Australian Government policy

Changes in the political environment has resulted in governments providing significant incentives to encourage the development of hydrogen production capabilities, while stimulating markets and market demand. As LCK already has this potential to produce hydrogen we are proactively responding to this substantial development. In response to the national and international focus on hydrogen the Australian government has made a number of important policy initiatives:

National Hydrogen Strategy:

Australia’s Chief Scientist, Alan Finkel has referred to hydrogen as the “Hero Fuel” because of its potential to reduce the risks associated with total reliance on renewable energy sources. His comments support the Federal Department of Industry’s National Hydrogen Strategy which sets a vision for a clean, innovative, safe, and competitive Hydrogen industry by 2030.

Low Emissions Technology:

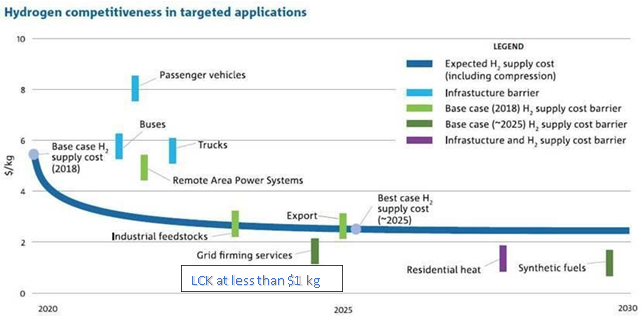

The Federal government has released its “Technology Investment Roadmap Discussion Paper” Its goal is to find a way to manufacture hydrogen at less than $2 per kilogram. LCK can produce at less than $1 per kg.

Advancing Hydrogen Fund:

The Federal government recently launched the $300m Advancing Hydrogen Fund (the Fund) through its Clean Energy Finance Corporation (CEFC) to invest in new hydrogen energy projects that included hydrogen from fossil fuels. This was an important change in the funding for hydrogen projects and was particularly relevant to LCK. As a result, we are now working on a submission to obtain funds for an ISG to hydrogen CO2 sequestration project at Leigh Creek.

Angus Taylor MP, the Federal Minister for Energy and Emissions Reduction, said the Fund’s goal was to back projects that could reach a long-term goal of producing hydrogen at $2 per kilogram – “where Hydrogen becomes competitive with alternative energy sources in large-scale deployment across our energy systems”. LCK will significantly better this target producing hydrogen at less than $1 per kilogram.

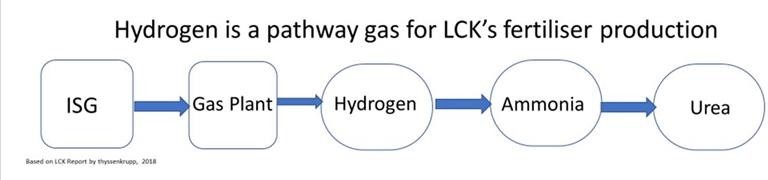

Ease of Hydrogen Manufacture at the LCEP

As illustrated below, hydrogen production from ISG operations is a gas produced on the pathway to urea manufacturing. LCK will produce commercial quantities of low-cost hydrogen, at a lower capital requirement than urea and LCK is exploring the potential available markets.

In terms of the quantity and cost of LCEP hydrogen, our numbers were confirmed by the thyssenkrupp report at up to 200,000,000 kg per annum at less than $1 per kilogram.

Obstacles to a Hydrogen Economy

An issue for LCK was that we can produce hydrogen at below $1 per kg which is much lower than current production costs. It is one thing to produce hydrogen, it is another to ensure the production of hydrogen is a commercial proposition with a commercial market. Hydrogen at

• Cheap production costs (which LCK can do) are required in order to develop an end-use;

• An end use is required in order to develop cheap production costs.

Cheap Production Cost

LCK’s main aim is to produce hydrogen and then ammonia for urea manufacture. Ultimately this will mean we could produce 2 million tonnes of urea from 200 million kg of hydrogen at <$1 per kg. However, if the market exists in Australia or an export market exists for hydrogen, we can divert excess hydrogen for sale as a standalone product.

Strategic Partners engagement ongoing

LCK major shareholder – China New Energy – is a subsidiary of Shaanxi Meijin (Meijin) a company listed on the Shanghai stock exchange. Meijin is already well placed in the Chinese hydrogen economy and in a position where it can expand internationally. Notably Meijin already constructs hydrogen vehicles, hydrogen fuel cells and hydrogen charging stations. Partnering with Meijin provides LCK with a significant advantage in developing a hydrogen fuel market within Australia. We are currently in discussion with Meijin to JV with them to bring their technology to Australia through LCK and to take our ISG process to China through their subsidiary CNE and will update the market on that progress.

Source: One of Meijing manufactured hydrogen buses in China

Next steps for the LCEP

The next development stages for the LCEP are focussed, naturally on Leigh Creek and on the commercial aspects. These will involve further studies of the market and opportunities for hydrogen with a focus on how we can utilise our hydrogen in a sensible profitable way in Australia. With our partner Meijin, LCK is well positioned to be at the forefront of the hydrogen development – both upstream and downstream in Australia.

LCK Managing Director’s comments

Phil Staveley Managing Director LCK said: “Whilst we are focussed on achieving production at the LCEP, we would be remiss if we did not also focus on the alternatives for commercialising the hydrogen that we produce. Hydrogen may prove to be an area of rapid growth in Australia and globally.”

About Leigh Creek Energy

Located in South Australia, Leigh Creek Energy Limited (ASX:LCK) is an emerging energy company focused on developing its Leigh Creek Energy Project (LCEP). The LCEP will produce nitrogenous fertiliser and hydrogen products from the remnant coal resources at Leigh Creek by utilising In Situ Gasification technologies. LCK is committed to developing the LCEP using a best practice approach to mitigate the technical, environmental, and financial project risks.

Read the most up to date Fuel Cell and Hydrogen Industry news at FuelCellsWorks