VANCOUVER, CANADA – Ballard Power Systems (NASDAQ: BLDP; TSX: BLDP) today announced consolidated financial results for the third quarter ended September 30, 2019. All amounts are in U.S. dollars unless otherwise noted and have been prepared in accordance with International Financial Reporting Standards (IFRS).

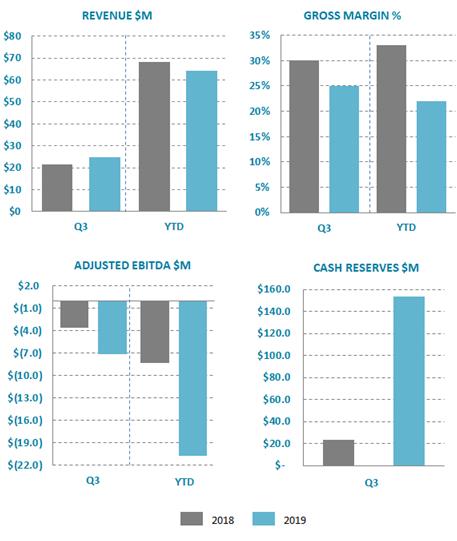

Randy MacEwen, President and CEO said, “Financial results for Q3 and year-to-date, together with a solid order book going forward, support our expectations for the full year. Ballard delivered Q3 revenue of $24.8 million, gross margin of 25%, Adjusted EBITDA of $(7.2) million and ending cash reserves of $153.4 million. We also announced new purchase orders for FCveloCity® fuel cell modules to be used in Heavy Duty Motive applications.”

Mr. MacEwen noted, “The global megatrend toward zero-emission mobility is accelerating and putting increased momentum behind fuel cell-based power for motive applications, including buses, commercial trucks, rail, marine and cars. Against this backdrop, Ballard made measurable progress in our strategic positioning during the past quarter. Further to the launches earlier this year of our next-generation LCS fuel cell stack and FCmoveTM power module – each featuring significant improvements in performance and cost – we are seeing growing market interest in these next-generation products, following positive product performance in initial bus tests. We are also progressing our advanced manufacturing plan in our Vancouver operations, with new manufacturing equipment, layout and processes that will reduce cycle time, improve yields, increase production capacity and further reduce product cost. And, we are progressing with our technology transfer program to the Weichai-Ballard joint venture and the construction of our JV manufacturing facility in China.”

Mr. MacEwen concluded, “We are reiterating Ballard’s full-year 2019 outlook. In addition, we look forward to strong growth in 2020 and beyond, as Ballard solidifies our leadership position in the fuel cell electric vehicle market.”

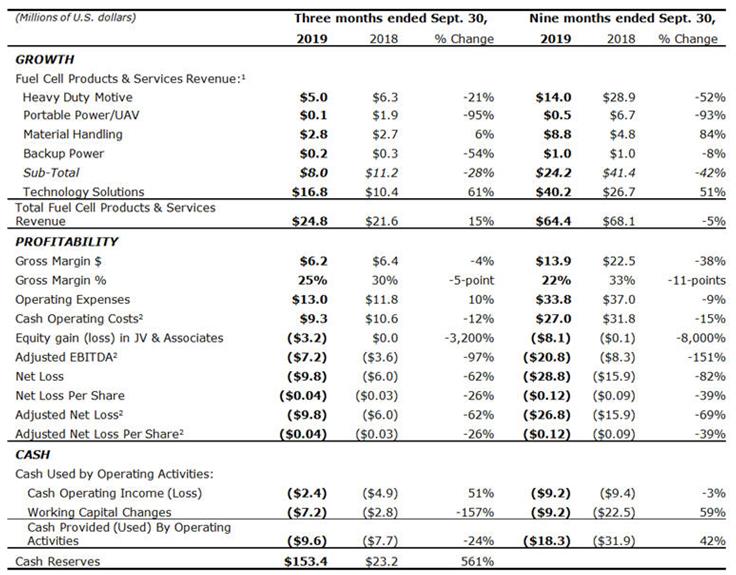

Q3 2019 Financial Highlights

(all comparisons are to Q3 2018 unless otherwise noted)

- Revenue was $24.8 million, up 15% on a year-on-year basis, reflecting increases in Technology Solutions and Material Handling, which more than offset declines in Portable Power/UAV and Heavy Duty Motive.

- The Power Products platform generated revenue of $8.0 million, a decrease of 28%:

- Heavy Duty Motive revenue was $5.0 million, a decrease of 21% due primarily to lower shipments of fuel cell products to customers in China;

- The Portable Power/UAV business generated $0.1 million, a decrease of 95% as a result of lower revenues generated by Protonex, primarily due to the disposition of Power Manager assets in Q4 2018;

- Material Handling revenue was $2.8 million, an increase of 6% primarily due to slightly higher shipments to Plug Power; and

- Telecom Backup Power revenue was $0.2 million, a decrease of 54% due primarily to a decline in hydrogen-based backup power product and service revenue.

- The Technology Solutions platform generated revenue of $16.8 million, an increase of 61% due primarily to amounts earned from the Weichai Ballard Hy-Energy Technologies Co., Ltd. (“Weichai-Ballard JV”) technology transfer program.

- Gross margin was 25%, a 5-point decrease primarily reflecting a shift to lower overall margin product and service revenue mix, including the loss of higher margin revenues generated by Protonex, due in part to the disposition of Power Manager assets in Q4 2018.

- Cash operating costs2 were $9.3 million, a decrease of 12% primarily attributable to lower product development costs combined with decreases in sales and marketing costs.

- Adjusted EBITDA2 was $(7.2) million, a decline of 97% or $3.5 million, primarily driven by higher equity in loss of investment in joint venture and associates of $(3.2) million attributed to the establishment of operations of the Weichai-Ballard JV, by an increase in operating expenses primarily as a result of an impairment loss on trade receivables for amounts owed to Ballard for product shipments to Wrightbus, partially offset by the decrease in Cash Operating Costs.

- Net loss was $(9.8) million, a decline of $3.8 million. Net loss also included equity in loss of investment in joint venture & associates of $(3.2) million, primarily attributable to the establishment of operations of the Weichai-Ballard JV.

- Net loss per share was $(0.04) compared to $(0.03) in Q3 2018.

- Cash used by operating activities was $9.6 million, an increase of $1.9 million reflecting cash operating losses of $2.4 million and working capital outflows of $7.2 million.

- Cash reserves were $153.4 million at September 30, an increase of 561% from the end of Q3 2018 and a decrease of 6% compared to the prior quarter.

- The Order Backlog at end-Q3 was $199.6 million, down from $211.6 million in the prior quarter and reflecting $12.8 million in new orders and $24.8 million in shipments during the quarter. At end-Q3 the 12-month Order Book was $123.6 million, a decrease of $3.1 million from the prior quarter.

Q3 2019 Operating Highlights

- Subsequent to the quarter, received a purchase order for 3 FCveloCity®-HD 100 kilowatt (kW) fuel cell modules from Germany-based BEHALA to power the world’s first zero-emission push boat. The boat, to be named Elektra, will be used primarily to transport goods between Berlin and Hamburg as well as on inner-city transport routes in Berlin.

- Subsequent to the quarter, received a purchase order for 9 FCveloCity®-HD 100kW fuel cell modules from Anglo American to power an Ultra-class mining truck (with one module to be maintained as a spare) during a demonstration project planned for the second half of 2020 in South Africa.

- Ballard was included in the S&P/TSX Composite Index effective September 23, 2019. Ballard is now one of approximately 240 out of the 1,500 companies listed on the Toronto Stock Exchange (TSX) to be included in the S&P/TSX Composite Index.

- Ballard was named to the inaugural TSX30, which recognizes the top 30 performing shares listed on the TSX over the 3-year period from July 1, 2016 to June 30, 2019. During this period BLDP share price rose 222% on the TSX, representing the 12thlargest share price appreciation among listed companies.

Q3 2019 Financial Summary

For a more detailed discussion of Ballard Power Systems’ third-quarter 2019 results, please see the company’s financial statements and management’s discussion & analysis, which are available at www.ballard.com/investors, www.sedar.com and www.sec.gov/edgar.shtml.

Conference Call

Ballard will hold a conference call on Thursday, October 31, 2019 at 8:00 a.m. Pacific Time (11:00 a.m. Eastern Time) to review third quarter 2019 operating results. The live call can be accessed by dialing +1.604.638.5340. Alternatively, a live audio and slide webcast can be accessed through a link on Ballard’s homepage (www.ballard.com). Following the call, the audio webcast and presentation materials will be archived in the Earnings, Interviews & Presentations area of the Investors section of Ballard’s website (www.ballard.com/investors).

About Ballard Power Systems

Ballard Power Systems’ (NASDAQ: BLDP; TSX: BLDP) vision is to deliver fuel cell power for a sustainable planet. Ballard zero-emission PEM fuel cells are enabling electrification of mobility, including buses, commercial trucks, trains, marine vessels, passenger cars, forklift trucks and UAVs. To learn more about Ballard, please visit www.ballard.com.

Read the most up to date Fuel Cell and Hydrogen Industry news at FuelCellsWorks