The Great Plains Institute has just released a publication titled An Atlas of Carbon and Hydrogen Hubs for United States Decarbonization. The atlas identifies areas of the United States that offer the capacity to help our nation expand and accelerate emissions reductions and carbon removal through focused coordination, deployment, and policy.

The development of carbon and hydrogen hubs is a crucial strategy for achieving economies of scale in the deployment of decarbonization technologies and associated infrastructure. Hubs are an opportunity to meet midcentury climate goals, retain and create high-wage energy, industrial, and manufacturing jobs, and provide environmental and economic benefits to local communities.

Here are a few key takeaways from the atlas:

- Carbon management and zero-carbon hydrogen are needed at scale to achieve our climate goals.

- Carbon and hydrogen hubs can focus planning, coordination, policy, and investment regionally to bring these required solutions to scale.

- Supportive federal and state policy is critical to scale up carbon management and zero-carbon hydrogen technologies and associated infrastructure.

Download the atlas or individual Carbon and Hydrogen Hub fact sheets.

Carbon and hydrogen hub opportunities span the United States

GPI has identified 14 hubs across eight regions of the United States. Carbon and hydrogen hub development opportunities are well distributed across the country, and the regions designated as potential hubs through this analysis are by no means exclusive. Since industrial production and emissions occur throughout the country, carbon capture, hydrogen production, and direct air capture facilities will need to be deployed wherever beneficial and feasible.

Figure 1. Potential carbon and hydrogen hubs in the US

Carbon management and hydrogen vital to decarbonization efforts

Why the focus on carbon and hydrogen together? According to global climate modeling scenarios by the United Nations Intergovernmental Panel on Climate Change (IPCC) and the International Energy Agency (IEA), we must reach net-zero emissions by midcentury to keep the average global temperature rise to 1.5°C to 2°C above preindustrial levels. Carbon management and hydrogen will play a vital role in meeting these emissions reduction goals in the United States and globally, particularly in hard-to-decarbonize sectors like industry and manufacturing.

IPCC and IEA modeling makes clear that large-scale carbon management is needed to meet midcentury global temperature targets, including through carbon capture retrofits of industrial facilities and power plants, and direct air capture facilities. In the latter half of this century, nearly all global modeling scenarios require economywide deployment of negative emissions technologies, such as direct air capture and bioenergy with carbon capture, to achieve net atmospheric carbon removal. These carbon management and storage technologies account for up to 12 gigatons of negative emissions annually by 2050, offsetting about 50% of midcentury annual global emissions, in the IPCC’s illustrative 1.5°C scenarios.

Greenhouse gas emissions from industrial energy use and production processes are hard to decarbonize through traditional renewable energy, electrification, and energy efficiency options. Many industrial products cannot be made without fuels that provide high-intensity heat or energy. Moreover, even with the decarbonization of energy inputs, many industries still release large volumes of carbon emissions as an inherent part of the chemistry of their key industrial processes, such as in steel, cement, and chemicals production.

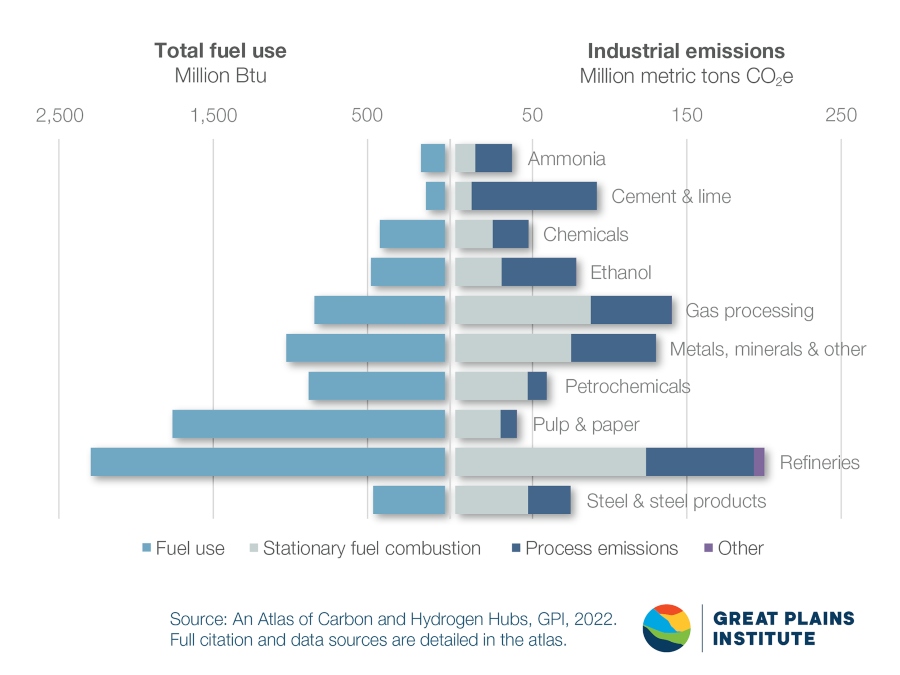

Figure 2. US industrial fuel use and emissions in select sectors

As shown in figure 2, process emissions make up a significant share of total emissions in many sectors, and have extensive associated fuel use. The entire industrial sector represents about 23 percent of the United States’ total of 6.5 gigatons of annual greenhouse gas emissions.

For those carbon-intensive industrial and transport applications where carbon capture is not feasible, hydrogen can act as a versatile energy carrier that, when produced with zero-carbon energy sources, can enable deep decarbonization. These applications include the use of hydrogen as an alternative to high-energy industrial fuels and blending hydrogen into existing natural gas systems. The IEA estimates that the production and use of zero-carbon hydrogen will be responsible for 13 percent of total annual emissions reductions by 2050.

In some key sectors, the technology and processes of carbon management and hydrogen production remain nascent. Economywide and at-scale commercial demonstration of these technologies and their associated infrastructure is thus essential to enabling widespread deployment sufficient to meet our climate obligations.

Carbon and hydrogen hubs as launch points for early investment

The co-located energy production, industrial and manufacturing capacity, and geologic storage resources of a hub region offer the potential to create economies of scale from investments in shared infrastructure. A hub approach also affords the opportunity to build an integrated value chain and marketplace for producers and consumers of hydrogen and captured carbon emissions.

Figure 3. Carbon and hydrogen hubs concept diagram

Figure 3 illustrates the interaction between industries participating in a hub, as well as the co-location of decarbonization technologies or strategies that harness the energy, industrial, and geologic assets of potential hub regions. GPI identified potential regional carbon and hydrogen hubs based on the following criteria:

- High concentration of large industrial facilities with significant emissions

- High quantities of fossil fuel use for on-site industrial energy production

- Presence of facilities qualifying for the federal 45Q tax credit for carbon capture retrofit, as well identified feasible near- and medium-term capture opportunities

- Current reported production of hydrogen and ammonia

- Large saline and fossil geologic formations for permanent carbon dioxide (CO2) storage

- Existing multimodal commodity distribution infrastructure, such as freight railroads, barge waterways and ports, and interstate highway routes for freight trucking

- Existing conventional energy distribution infrastructure for hydrogen blending and established rights-of-way for low-impact CO2 and hydrogen transport infrastructure

Carbon capture and storage opportunities

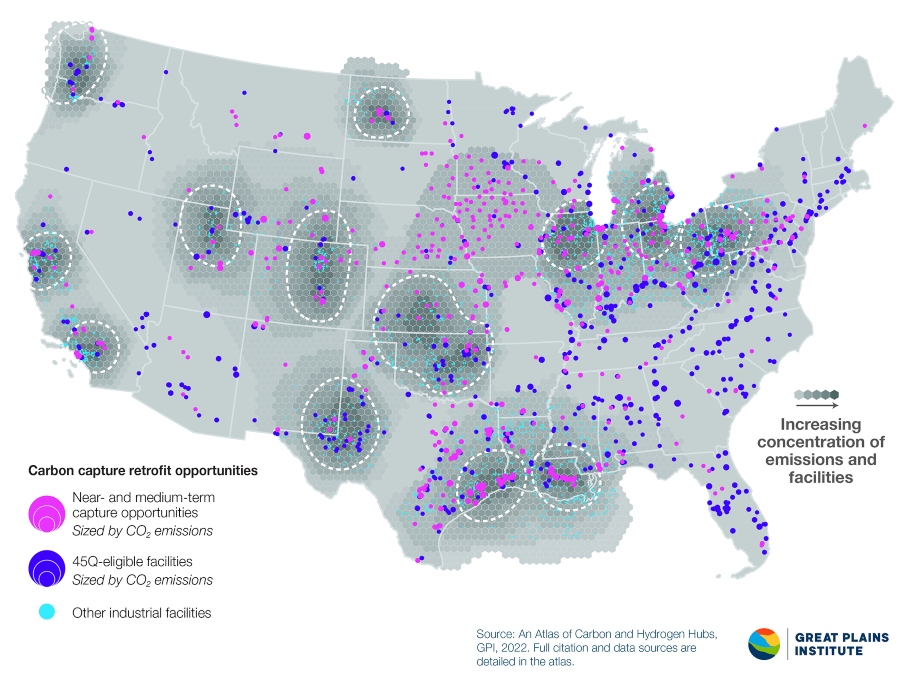

GPI identified 542 facilities as prime candidates for carbon capture retrofit over the next 10 to 15 years. These facilities represent a launching point for investment in carbon capture and storage, where the economics of capture appear favorable for near-term investment. Additional 45Q-eligible facilities that are expected to continue operating and provide employment through midcentury should also be considered opportunities for retrofit after this initial 10-15 year period.

Figure 4. Carbon capture retrofit opportunities at US industrial and power facilities

Near-term candidates for carbon capture deployment are largely clustered in the regional hubs identified in this atlas. Their geographic concentration further optimizes the potential project economics of these targets for carbon capture retrofit by enabling coordination between facilities and subsequent economies of scale in developing shared transport and storage infrastructure.

Figure 5. Ample opportunities for secure geologic storage of CO2 in the US

According to the US DOE, the US has vast physical capacity to permanently store thousands of years of US emissions at current levels in secure saline geologic formations. However, local site characterization will be needed to identify suitable CO2 injection sites for project development. Site access and cost of injection also factor into geologic storage access for a given project.

Locating carbon capture and direct air capture in areas with existing saline storage capacity can minimize transport costs, land use, and local impact. However, not all potential carbon capture and direct air capture must be co-located to saline formations. Shared transport infrastructure can achieve beneficial economies of scale, enabling investment break-even for industrial capture retrofit and direct air capture deployment, even when longer distance transport to a final storage site is required.

Hydrogen opportunities

Hydrogen is a versatile fuel source that can be stored for long periods of time and can reduce the carbon intensity of power generation, heating systems, industrial production, and certain transport applications. Hydrogen can also act as an energy carrier, be combusted for energy without emitting greenhouse gases, and enable energy storage that can cover intermittent or seasonal periods of low energy production from renewable electricity generation.

Figure 6. Current US hydrogen production and industrial fuel use

When produced with zero- or low-carbon energy, hydrogen is a powerful decarbonization solution for multiple sectors and numerous end uses that are difficult to electrify, such as industrial process heat, heavy trucking, iron and steel production, and marine shipping. Hydrogen use can also displace fossil-based medium- and high-grade heat in industrial applications that do not lend themselves to electrification.

As demand for hydrogen as an energy carrier, transportation fuel, and high-grade industrial fuel grows, new low- and zero-carbon hydrogen production facilities utilizing a variety of production configurations and feedstocks will be required throughout the country.

The hubs identified in this atlas provide an opportunity to co-locate new hydrogen facilities in areas with existing hydrogen and ammonia distribution infrastructure, natural gas pipelines, biomass feedstock resources, and permanent geologic CO2 storage potential. These hubs offer initial target areas to focus investment and coordination to scale low- and zero-carbon hydrogen production and use from initial commercial demonstration to eventual economywide deployment.

A catalyst for decarbonization: policy drivers of hub development

Federal policy is increasingly favorable for carbon and hydrogen hub development. Congress has recently enacted groundbreaking bipartisan legislation, including reform and expansion of the 45Q tax credit in 2018 to incentivize carbon capture, direct air capture, and carbon utilization projects, as well as passage of the infrastructure bill last year. The infrastructure bill provides over $20 billion in funding to demonstrate carbon management and hydrogen technologies at scale, build out transport and storage infrastructure, and develop regional hydrogen and direct air capture hubs.

Building on this framework of federal tax credits, grants, and low-interest loans, further federal and state policy is needed to achieve technology and infrastructure deployment objectives consistent with midcentury climate goals while sustaining and expanding skilled jobs that pay above prevailing wages, reducing environmental burdens on local communities, and supporting existing and new domestic industries.

Additional policy priorities include transformative enhancements to the 45Q tax credit and other improvements to federal energy and industrial tax credits now pending in budget reconciliation legislation before Congress, together with complementary state policies. State policy priorities include those that support planning within and between states, implement enabling regulation and permitting, provide supplementary financing and incentives, and build markets for low- and zero-carbon electricity, fuels, and products.

These additional policies needed for at-scale deployment of carbon and hydrogen hubs are detailed in the atlas and will be discussed in a follow-up blog post.

Read the most up to date Fuel Cell and Hydrogen Industry news at FuelCellsWorks