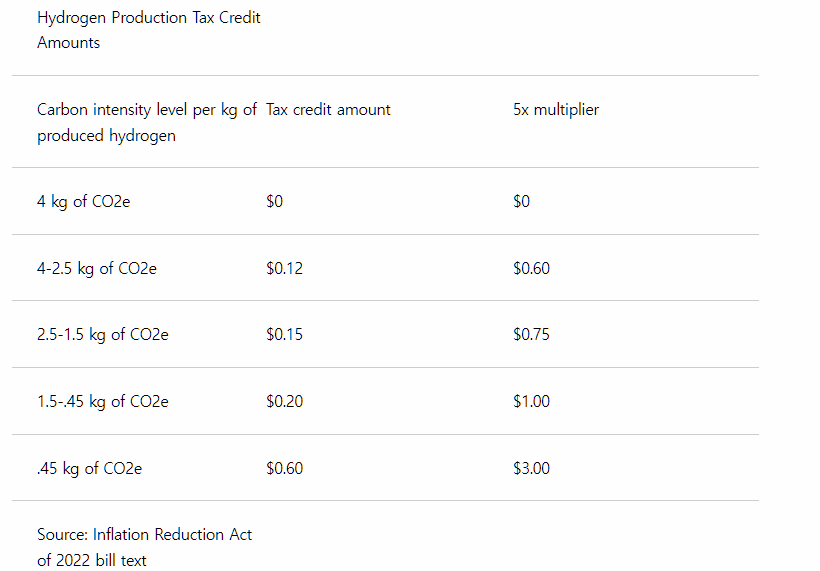

- As in Build Back Better, credits capped at $3/kg.

- New bill brings credits close to reality.

The US Inflation Reduction Act, announced July 27, includes support for hydrogen through a new tax credit that will award up to $3/kg for low carbon hydrogen, subject to certain requirements.

he multiplier mechanism would bring the tax credit amounts in the range that was previously proposed in the Build Back Better Act, which would also have offered up to $3/kg of clean hydrogen depending on its carbon intensity. The multiplier mechanism would be triggered if producers begin building new facilities within a certain time period and if they meet certain wage and labor requirements for the project, according to the bill’s text, which was revealed July 27 by Senate Democrats. No Senate Republicans support the bill.

Projects that meet those requirements can receive tax credits ranging from 60 cents/kg to $3/kg, while those that don’t are eligible for credits in the 12 cents/kg to 60 cents/kg range.

Similar to 2021’s Build Back Better Act, exact credit amounts will be determined by an accounting of the hydrogen’s full lifecycle greenhouse gas emissions. That emissions measurement scheme will be based on Argonne National Laboratory’s Greenhouse Gases, Regulated Emissions, and Energy Use in Technologies Model, known as GREET.

Janice Lin, CEO of the Green Hydrogen Coalition, applauded the decision to keep tax credit amounts tied to lifecycle emissions analyses.

Janice Lin, CEO of the Green Hydrogen Coalition, applauded the decision to keep tax credit amounts tied to lifecycle emissions analyses.

“A well-to-gate methodology is crucial because it rigorously accounts for the climate impacts associated with hydrogen production pathways and would establish a level playing field when comparing the carbon intensity of alternative pathways,” Lin said in an email July 28. “A nationally-applicable well-to-gate carbon intensity framework will create alignment, transparency and facilitate the development of a credible and economically viable/tradable green and clean hydrogen market for the United States that will accelerate decarbonization.”

Also included in the bill is a $2 billion fund earmarked for grants supporting the domestic production of clean transportation technologies, including fuel cell electric vehicles.

All told, the hydrogen elements in the draft legislation, have the potential to impact all of the US economy’s hard-to-abate sectors, said Jeff Bechdel, spokesperson for hydrogen advocacy group Hydrogen Forward.

“This will encourage further growth of clean hydrogen, which will play a critical role in addressing hard-to-decarbonize sectors like transportation, heavy industry, agriculture and power generation,” Bechdel said in an email.

Hydrogen booster

It may not be a surprise to see hydrogen spending provisions preserved in this new, slimmed-down version of Democrats’ climate package. Democratic Senator Joe Manchin of West Virginia, who has until now single-handedly blocked the party’s ambitious climate agenda, has been bullish on building out a US hydrogen economy.

Until July 27, Manchin had rejected the Biden administration’s climate agenda by blocking the Build Back Better Act.

The announcement of the bill comes follows’ signaled strong support for clean hydrogen tax credits during a Senate Energy and Natural Resources Committee hearing. It is expected to be voted on through the Senate’s budget reconciliation process the week of Aug. 1.

Source: Hydrogen tax credits preserved in new US Inflation Reduction Act July 29, 2022

Read the most up to date Fuel Cell and Hydrogen Industry news at FuelCellsWorks