Entering the era of green hydrogen

The idea of using hydrogen as a green energy vector is not new at all, in fact water electrolysis has existed for more than 200 years.

However, up until now its large-scale commercial application was limited by the high cost compared to primary energy sources such as oil and gas. The current transition away from carbon-based energy brought green hydrogen back into focus especially as an alternative energy carrier for applications that are challenging to electrify, such as heavy vehicle transportation and industry.

Hydrogen offers the potential to decarbonize these sectors in a cost-effective way, which is why major economies around the globe have allocated billions of dollars to the development of key enabling technologies for green hydrogen.[1] In the European Union (EU) this became apparent when the foundation of the “European Green Deal” made hydrogen a priority focus and the European industry association Hydrogen Europe announced the target to deploy 80 GW of green hydrogen production capacity by 2030.

At the same time, rising CO2 prices, falling costs of renewable energy and the continuous reduction of electrolyzer costs put green hydrogen increasingly within reach. According to the International Energy Agency, the demand for low-carbon hydrogen will be almost 8 Mt/y by 2030.[2]

Electrolysis – the key towards low-cost green hydrogen

Green hydrogen is produced by water electrolysis, a technology that converts water and renewable energy into hydrogen and oxygen. The production costs of green hydrogen are dominated by the cost of renewable energy. This is not expected to change in the future despite significant reductions in LCOE and further increasing electrolysis efficiencies. The second most important cost driver is CAPEX: In 2020, electrolyzer system costs were at around 1,000 USD/kW following a learning rate of ~15%, which is projected to yield a cost reduction of ~60% by 2030 (see Figure 1).

CAPEX reductions are mainly expected as a consequence of industrialization and automation of component and system manufacturing (economies of scale) as well as technology innovations. The catalyst coated membrane alone contributes to ~11% of the total system costs.[3] The reduction of the platinum loading and the development of cost-effective membranes are key to bringing down costs and unlocking the market potential of green hydrogen.

Figure 1: Expected electrolyzer learning curve and 2020 CAPEX split of a 1 MW electrolyzer

Polymer membranes – cost and performance drivers for green hydrogen

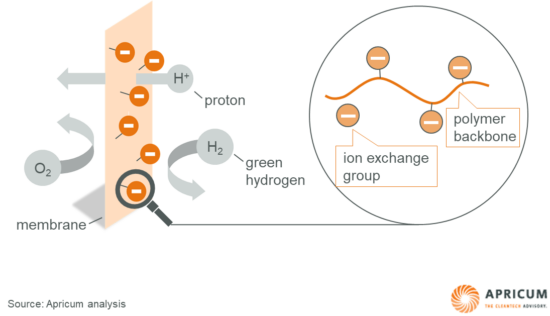

The membrane is one of the most important cost and performance drivers in electrolyzers and fuel cells as it accounts for a significant share of the total system costs and defines the efficiency, power density and lifetime of the system. The membrane’s primary job is to conduct ions while protecting the system against electrical short circuiting, however, OEMs also care about many other key performance indicators such as gas crossover, water management, dimensional stability and chemical and mechanical robustness. Polymer electrolyte membranes (PEM) typically comprise a polymer backbone and negatively charged ion exchange groups. Additional additives and reinforcements may be added to increase stability and lower gas crossover.

Figure 2: Working principle of proton exchange membranes for water electrolysis

The most widely used membrane class for both electrolysis and fuel cells is based on Perfluorosulfonic Acid (PFSA), a costly perfluorinated ionomer produced via the copolymerization of tetrafluoroethylene and perfluorosulfonyl vinylether. The high complexity of the production route and the toxicity of intermediates limit the potential for cost reduction and slow down the expansion of production capacity. In fact, only a few manufacturers around the globe handle the highly explosive precursors required for the PFSA-synthesis. Multiple strategies have been developed to reduce the cost of classic PFSA-membranes.

For example, W.L. Gore blends the PFSA ionomer with lower-cost polytetrafluoroethylene (PTFE), which directly reduces the PFSA-demand, strengthens the membrane and lowers gas crossover. The Gore Select® membrane has become a state-of-the-art material for fuel cells and is incorporated on a large scale in the prestigious Toyota Mirai vehicle. A similar “reinforcement” approach is used by several other PFSA-membrane developers such as Chemours (ex Dupont), 3M, Solvay and Giner Labs. Alternatively, non-fluorinated or partially fluorinated polymers can be used to reduce the production costs. Examples include the former BAM-series from Ballard Power Systems and the Celtec®-series from BASF. Despite the number of commercial membrane technologies, there is still a significant need for lower cost membranes that show comparative performance and durability levels to PFSA.

Entry points for the green hydrogen membrane market

Market entry into membranes for green hydrogen requires market and technical expertise. Technical expertise ideally covers different sectors such as polymer manufacturing, chemical synthesis and thin-film processing. Green hydrogen membranes thus offer a market opportunity for various new entrants:

- Polymer manufacturers: Various fluorinated polymers and polyolefins can be used as a polymer backbone and a reinforcement material in membranes for fuel cells and electrolyzers. Polymers are either functionalized directly or blended with ionomers to yield ionic conductivity.

- Chemical/engineered materials players: The manufacturing of membranes or membrane precursors and the functionalization thereof can leverage multiple infrastructures used in other (specialty) chemical production processes and engineered materials.

- Thin film/foil processing industry: Membranes for green hydrogen are typically produced via solution casting or extrusion to achieve thicknesses in the micrometer scale.

Apricum’s services for entering the green hydrogen membrane market

Companies interested in entering the green hydrogen membrane market need to address multiple topics to develop a competitive strategy and to create a viable business case. An early and diligent evaluation of the product-market fit, the addressable market size, the competitive landscape and the targeted product value can save resources later down the road. Additional strategic components such as recycling, partnerships and vertical integration can significantly impact the economic attractiveness and may accelerate market entry.

Apricum offers long standing experience in addressing such questions combined with deep technological and industry knowledge in the field of membranes and green hydrogen. Apricum’s services include strategy and business model development, R&D roadmap design, value modelling, pricing strategy development, partnering structures and M&A/fundraising.

For more information, please contact Partner Florian Haacke, head of Apricum’s materials practice

[1] Examples in Europe include Spain (EUR 9B), Germany (EUR 9B), France (EUR 7B) or Italy (EUR 5B)

[2] IEA (2020), Hydrogen, IEA, Paris www.iea.org/reports/hydrogen

[3] National Renewable Energy Laboratory Technical Report 2019

Read the most up to date Fuel Cell and Hydrogen Industry news at FuelCellsWorks